Complete Registration Process in 3 Simple Steps

The Exness sign-up process for Kenyan traders is quick and can be completed in three steps:

- Create an Account: Visit the Exness website (exness.com) and click “Open an Account” at the top right. Fill in your email, phone number, and a secure password.

- Verify Your Profile: Submit proof of identity (e.g., passport or Kenyan ID) and proof of residence (e.g., utility bill or bank statement) to complete KYC verification.

- Fund and Trade: Choose a trading account type, deposit funds via M-Pesa or bank transfer, and start trading.

Ensure all details match your official documents to avoid delays.

It takes about 5–10 minutes to register, with verification typically completed within 24 hours.

Phone & Email Verification Process

After entering your email and phone number during registration:

- Exness sends a 6-digit code to your email. Enter it to verify your email address.

- A code is sent via SMS or phone call to your mobile number (+254 for Kenya). Input this code to confirm your phone.

Use an active email and phone number, as these are used for account recovery and security notifications. Verification is mandatory for full account access, including deposits and trading. If codes don’t arrive, check spam folders or resend the code.

Personal Information Registration

During registration, provide accurate personal details:

- Full name (as shown on your ID).

- Country of residence (Kenya).

- Email address and phone number.

- Preferred account currency (KES is available to avoid conversion fees).

These details must match your verification documents to pass KYC checks. After submitting, you’ll gain access to the Personal Area, where you can manage accounts and settings. Double-check entries to prevent issues during verification.

Exness Kenya KYC Verification

KYC (Know Your Customer) verification is required to ensure account security and lift deposit limits. To verify:

- Log into the Personal Area and click “Complete Profile.”

- Upload Proof of Identity (POI): Kenyan national ID, passport, or driver’s license.

- Upload Proof of Residence (POR): A utility bill, bank statement, or government-issued letter (less than 6 months old) showing your name and physical address. P.O. boxes are not accepted.

- Answer questions about your income source, profession, and trading experience.

Verification usually takes a few minutes but may take up to 24 hours for manual checks. Ensure documents are clear and match registration details. If rejected, check feedback in the Personal Area and resubmit. Unverified accounts face deposit limits and restricted trading after 30 days.

Start Trading Now with Exness

Open an Exness account today and start your trading journey in Kenya. Whether you’re new to trading or an experienced investor, Exness offers a user-friendly platform with competitive spreads and flexible leverage options. Take advantage of fast order execution and a wide range of financial instruments to enhance your trading experience.

Choosing the Right Account Type During Sign Up

Exness offers several account types for Kenyan traders, each suited to different trading styles:

| Account Type | Minimum Deposit | Spreads | Best For |

| Standard | $10 | From 0.3 pips | Beginners, casual traders |

| Standard Cent | $10 | From 0.3 pips | Small trades, new traders |

| Pro | $200 | From 0.1 pips | Experienced traders |

| Raw Spread | $200 | From 0.0 pips | High-volume, low-cost trading |

| Zero | $200 | 0 pips (95% of time) | Scalpers, precise trading |

Standard accounts are ideal for beginners due to low deposits and simple features. Pro, Raw Spread, and Zero accounts suit experienced traders needing tighter spreads. All accounts support KES and can be swap-free for Islamic traders. Compare features in the Personal Area before choosing.

Demo vs Real Account Registration

- Demo Account: Created automatically during sign-up with $10,000 in virtual funds. It’s risk-free, ideal for practicing strategies, and expires after 30 days unless used actively.

- Real Account: Requires KYC verification and a deposit to trade live. Offers full access to markets and profits but involves real financial risk.

Both are set up in the Personal Area by default for MT5. Kenyan traders should start with a demo to test platforms like MT4 or Web Terminal before opening a real account. To switch, select “Open New Account” in the Personal Area.

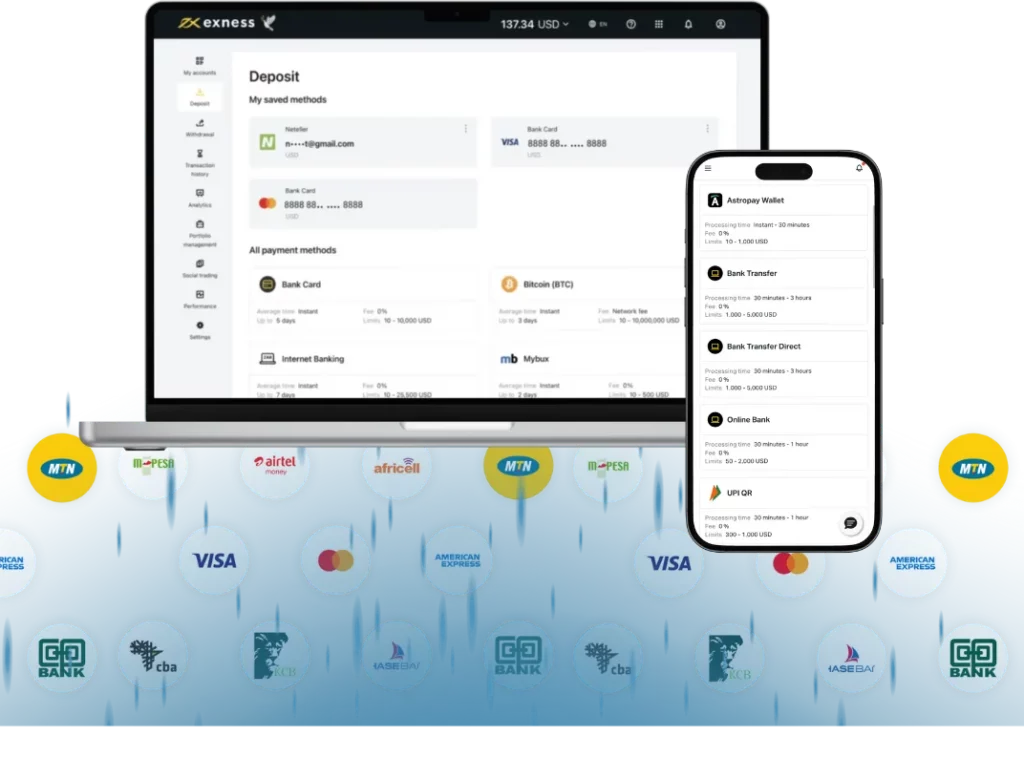

Funding New Exness Account

Kenyan traders can fund accounts via multiple methods, with M-Pesa and bank transfers being the most popular. Deposits are instant, and Exness charges no fees, though payment providers may apply charges.

MPesa Deposit Options for Kenyan Traders

To deposit using M-Pesa:

- Log into the Personal Area, go to “Deposit,” and select M-Pesa.

- Choose the trading account, currency (KES or USD), and deposit amount (minimum $10).

- Enter your M-Pesa-registered phone number (+254).

- Confirm the transaction on your phone via the M-Pesa prompt.

Funds appear in your account within minutes. M-Pesa is widely used in Kenya for its speed and convenience, but ensure your M-Pesa account has sufficient funds.

Bank Transfer Funding Methods

To deposit via bank transfer:

- In the Personal Area, select “Bank Wire Transfer” under “Deposit.”

- Choose the account and enter the deposit amount (minimum $50).

- Follow instructions to transfer funds from your Kenyan bank account to Exness’s provided bank details.

Transfers take 1–3 days to process, depending on the bank. Verify your account fully before using this method, as it’s required for bank deposits. Check with your bank for any transfer fees.

Post-Registration Setup

After registration and funding:

- Set Up Security: Enable two-factor authentication (2FA) in the Personal Area under “Security Settings” for extra protection.

- Choose a Platform: Download MT4, MT5, or use the Web Terminal or Exness Trader app.

- Customize Settings: Adjust leverage (up to 1:2000, use cautiously) and apply risk management tools like stop-loss orders.

- Explore Tools: Use free analysis tools like Trading Central or FXStreet News in the Personal Area.

Kenyan traders should test settings in a demo account to avoid costly mistakes. Monitor account activity regularly for security.

Downloading Trading Platforms

Exness offers multiple platforms for Kenyan traders:

- MetaTrader 4 (MT4): Popular for forex, with robust charting. Download from the Exness website or app stores.

- MetaTrader 5 (MT5): Advanced features, supports more instruments. Available on desktop, mobile, or web.

- Exness Trader App: Mobile app for trading and account management. Download from Google Play or App Store.

- Web Terminal: Browser-based, no download needed. Access via the Exness website.

To install, visit the “Platforms” section on exness.com, select your device, and follow the prompts. Log in using your account number and trading password (found in the Personal Area). Practice on MT4/MT5 demo accounts to get familiar with tools like indicators and order types.

Common Registration Questions from Kenyan Traders

Document Verification

Verify your account quickly with your Kenyan ID card or passport. For proof of address, submit a recent utility bill or bank statement with your name and current address. Documents must be less than 3 months old and clearly legible.

M-Pesa Deposits & Withdrawals

Link your M-Pesa account directly through the Exness platform for instant deposits starting from just KES 1300. Withdrawals typically process within 15 minutes with no hidden fees. Transaction limits align with standard M-Pesa regulations.

Demo Account Access

Practice risk-free on our full-featured demo account with KES 100,000 in virtual funds. All trading tools and features are identical to live accounts. No expiration date—use it as long as needed before transitioning to real trading.

Switching Between Account Types

Easily switch between Standard, Cent, Zero, Pro or Raw Spread accounts directly from your dashboard. No need to verify documents again.

Forex Trading with Low & Stable Spreads

Trade global forex with low spreads and superior conditions for better results, maximizing your potential with each trade.

Frequently Asked Questions

How do I sign up for an Exness account in Kenya?

To sign up for an Exness account in Kenya, visit the official Exness website and click on the “Sign Up” button. Fill out the required personal information, create a secure password, and verify your email and phone number to complete the registration.

What documents are required for Exness Kenya registration?

During the sign-up process, you will need to submit identity verification documents, such as a government-issued ID, proof of address (e.g., utility bill), and sometimes a selfie to confirm your identity and meet regulatory requirements.

Is there a minimum deposit required to open an Exness account in Kenya?

Yes, Exness has a minimum deposit requirement, but it varies depending on the account type you choose. For most account types, the minimum deposit can start as low as $1, but higher deposit amounts may be needed for more advanced accounts.

Can I use Kenyan mobile money services for depositing into Exness?

Yes, Exness supports multiple payment methods, including mobile money services like M-Pesa for Kenyan traders. You can easily deposit funds into your Exness account using mobile money options available in Kenya.

Can I open an Exness demo account in Kenya?

Yes, Exness allows you to open a demo account in Kenya. A demo account is ideal for practicing trading strategies and familiarizing yourself with the platform before trading with real money.

How long does it take to verify my Exness account in Kenya?

Account verification with Exness typically takes between a few minutes to a couple of days, depending on the completeness of your documents and the verification process. Ensure you submit clear and valid documents for faster approval.